In today's fast-evolving business landscape, the intersection of culinary ventures and fintech innovations is becoming increasingly prominent. As the foodservice industry grapples with the challenges of the modern marketplace, companies are turning to mergers and acquisitions as a strategic tool for growth and resilience. This dynamic environment presents unique opportunities for entrepreneurs, investment bankers, and private equity firms to reshape the culinary experience while enhancing financial technology solutions tailored for the sector.

As we explore this landscape, we will delve into notable players such as Merrill Lynch and JP Morgan, who are instrumental in facilitating these transactions. We will examine case studies like the acquisition strategies employed by companies in frozen food manufacturing and the restaurant industry, alongside the rise of merchant branded fintech platforms like Lendaily Inc. and FuturePay Holdings. These developments not only influence the retail and institutional food segments but also reflect broader economic trends, such as the influence of political science on business strategies in various regions, including third world governments in Kenya. Join us as we navigate this exciting terrain, leveraging expertise from institutions such as St. Lawrence University and insights from relevant stakeholders to understand how M&A strategies are paving the way for innovation and growth in the foodservice landscape.

Overview of the Foodservice Landscape

The foodservice industry is a dynamic and multifaceted sector that plays a crucial role in the global economy. It encompasses a wide range of businesses, including restaurants, catering services, and institutional food suppliers. As consumer preferences evolve towards healthier options and convenient dining experiences, companies in this industry are increasingly focused on innovation and adaptation. From fine dining establishments to fast-casual chains, the landscape is competitive, driven by changing tastes and the demand for quality and sustainability.

In recent years, the importance of technology has surged within the foodservice sector, leading to the rise of fintech innovations that streamline operations and enhance customer experiences. Companies like Lendaily Inc. and FuturePay Holdings are at the forefront of this transformation, offering merchant branded fintech solutions that facilitate payment processing and financial management for foodservice operators. These technological advancements not only improve efficiency but also empower businesses to better understand their consumers and manage their financial health.

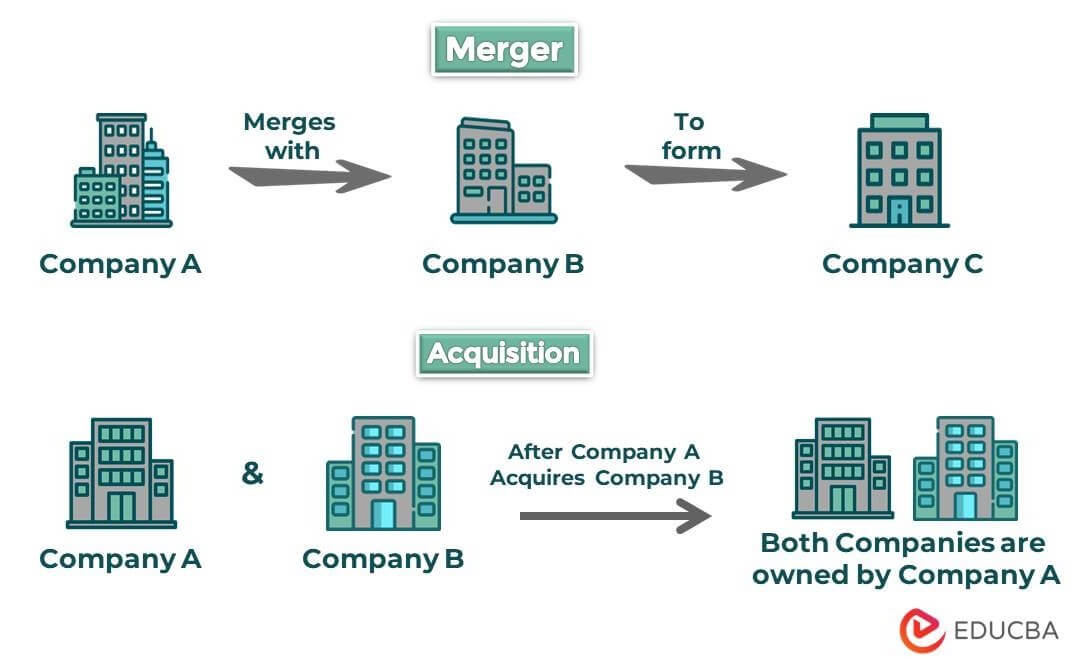

Mergers and acquisitions have become a common strategy for growth and expansion in the foodservice landscape. Major players are increasingly seeking to enhance their market position through strategic alliances and buy-side representation from investment banks such as Merrill Lynch and JP Morgan. The consolidation trend reflects the desire to tap into new market segments, strengthen supply chains, and leverage economies of scale. As entrepreneurs and established firms navigate this landscape, the interplay between culinary ventures and corporate finance becomes a critical aspect of sustaining competitive advantage in an ever-evolving industry.

Mergers and Acquisitions in Foodservice

The foodservice industry has become a dynamic landscape for mergers and acquisitions, with various players seeking to enhance their market presence and operational efficiencies. Major investment banks like Merrill Lynch and JP Morgan have been instrumental in facilitating these transactions, providing the necessary corporate finance expertise to navigate the complexities of the sector. As entrepreneurs look to expand their businesses, leveraging M&A strategies allows for rapid scaling by acquiring established brands, thereby tapping into existing customer bases and distribution channels.

Recent trends indicate a surge in private equity involvement, particularly focusing on the retail and institutional food sectors. Companies are becoming more strategic in their acquisition targets, often seeking complementary services or innovative products, such as frozen food manufacturing or home meal replacements. This evolution is characterized by a shift towards greater collaboration between foodservice entities and fintech companies, reflecting a broader trend of integrating technology to optimize operations and enhance customer experiences.

The intersection of culinary ventures and financial innovation presents unique opportunities. As organizations like Lendaily Inc. and FuturePay Holdings introduce merchant branded fintech solutions, foodservice operators are finding new ways to improve cash flow and streamline payment processes. This synergy not only benefits the companies involved but also enhances consumer convenience, thereby fostering growth within the industry.

The Role of Fintech in Foodservice Innovation

The integration of fintech solutions within the foodservice industry has revolutionized how businesses operate and connect with consumers. With the rise of mobile payments, digital wallets, and seamless transaction processes, restaurant owners and food retailers can improve customer experiences while streamlining their operations. Companies like Lendaily Inc. and FuturePay Holdings are at the forefront, offering merchant branded fintech solutions that enable foodservice operators to enhance payment options, manage cash flows more effectively, and leverage data analytics for better decision making.

As dining habits evolve, particularly with the growth of home meal replacement options, fintech innovations allow for agile responses to consumer trends. The foodservice industry is witnessing an influx of digital platforms that facilitate ordering, delivery, and payment, significantly increasing customer engagement. This shift not only benefits consumers through greater convenience but also provides entrepreneurs within the food ecosystem an opportunity to innovate and adapt quickly to market demands. M&A strategies that focus on fintech capabilities can thus create a competitive edge for food businesses looking to enhance their service offerings.

Moreover, the collaboration between the fintech industry and foodservice extends beyond just payment processing; it encompasses areas such as supply chain financing and improving operational efficiencies. By adopting advanced financial technologies, foodservice companies can gain better insights into their financial health, negotiate better terms with suppliers, and reduce waste through optimized inventory management. Investment firms like Merrill Lynch and JP Morgan recognize the potential of these fintech solutions in facilitating mergers and acquisitions, positioning businesses for growth in a dynamic market landscape.

Case Studies: Successful M&A Transactions

In the dynamic foodservice industry, successful mergers and acquisitions can serve as a powerful strategy for growth and expansion. One notable example is the acquisition of Emily's Market by a prominent private equity firm. This transaction not only enhanced Emily's market presence but also allowed the firm to leverage innovative business models in the retail food sector. By integrating advanced operational techniques and supply chain efficiencies, the acquisition paved the way for a stronger foothold in the home meal replacement industry, catering to evolving consumer preferences.

Another significant transaction involved Hunter Wise Financial Group's buy-side representation in the merger between a frozen food manufacturing company and a major player in the restaurant industry. This deal exemplified how strategic alignment of core competencies can unlock new market opportunities. By combining the strengths of both companies, they were able to enhance their product offerings and improve distribution networks, thus driving growth in an increasingly competitive landscape.

In the fintech space, the merger between Lendaily Inc. and FuturePay Holdings showcased the potential of merchant branded fintech solutions. This transaction combined Lendaily's innovative financing options for foodservice businesses with FuturePay's advanced payment processing technology. The resulting synergy not only improved operational efficiency but also positioned the newly formed entity to offer unique financing solutions tailored for the retail food and institutional food sectors, thus addressing the diverse needs of stakeholders across the foodservice landscape.

Challenges and Opportunities in Corporate Finance

The corporate finance landscape is continually evolving, particularly within industries like foodservice and fintech. Investment bankers face challenges such as fluctuating market conditions, increasing regulatory scrutiny, and the complexity of cross-border transactions. These factors can impact deal velocity and increase the cost of capital, particularly for transactions involving private equity. Navigating these hurdles requires a robust understanding of market dynamics and the ability to provide strategic guidance to clients.

However, these challenges also present numerous opportunities for those adept at maneuvering through them. For example, the rise of merchant branded fintech solutions has created new avenues for investment and growth within the foodservice sector. Companies like Lendaily Inc. and FuturePay Holdings are paving the way for innovative payment options that cater to changing consumer preferences. Investment bankers who can identify and capitalize on these trends can position their clients for success, unlocking value in both retail and institutional food sectors.

Moreover, the ongoing demand for home meal replacement options has led to increased interest in frozen food manufacturing and restaurant acquisitions. Financial institutions like Merrill Lynch and JP Morgan are strategically placing bets on transformative M&A transactions that can reshape the market. For entrepreneurs and business developers, this presents an ideal moment to engage in corporate finance activities that align with emerging consumer trends, potentially leveraging partnerships and funding opportunities to drive growth and innovation in the evolving foodservice landscape.

Future Trends in Foodservice and Fintech

The convergence of the foodservice and fintech industries is creating a dynamic landscape rich with opportunities for innovation and growth. One significant trend is the rise of digital payment solutions tailored for the foodservice sector. As more consumers seek convenience, businesses are adopting merchant branded fintech solutions to streamline transactions. Companies like Lendaily Inc. and FuturePay Holdings are at the forefront, offering platforms that integrate payment processing with customer loyalty programs. This integration not only enhances the customer experience but also provides valuable data for business development and targeted marketing efforts.

Another trend shaping the future of these industries is the increasing focus on sustainability and health-conscious dining options. The home meal replacement industry is expanding, driven by consumer demand for nutritious and convenient meal solutions. Foodservice entrepreneurs are leveraging technology to create offerings that cater to health trends, such as plant-based meals and organic ingredients. Additionally, institutions are incorporating these options into their catering services, reflecting a broader shift towards healthier eating habits. This emphasis on wellness is likely to attract investment from private equity firms looking to capitalize on the growing market.

Lastly, the foodservice industry is expected to see continued consolidation through mergers and acquisitions as companies seek to enhance operational efficiencies and expand their market reach. Large firms are increasingly eyeing smaller, innovative companies like Emily's Market and firms that specialize in frozen food manufacturing for potential acquisition. This strategic move allows established players to diversify their portfolios and tap into niche markets. Investment banks, including Merrill Lynch and JP Morgan, play a critical role in facilitating these transactions, guiding clients through the complexities of corporate finance in both the foodservice and fintech sectors.

Conclusion: Strategic Insights for Entrepreneurs

As the foodservice industry continues to evolve, entrepreneurs must adopt a forward-thinking approach to navigate the complexities of mergers and acquisitions. The alignment of culinary ventures with fintech innovations presents a unique opportunity for growth. Understanding key players such as Merrill Lynch and JP Morgan, along with private equity strategies, can enhance business development efforts and attract potential investors. The integration of technology into foodservice operations can streamline processes and improve customer engagement, making it essential for entrepreneurs to stay abreast of industry trends.

For those looking to enter the retail and institutional food sectors, developing a robust network is vital. Engaging with firms like Hunter Wise Financial Group for buy-side representation can provide invaluable insights during acquisition processes. Entrepreneurs should consider the successful strategies employed in the frozen food manufacturing and home meal replacement markets, as these segments continue to gain traction among consumers. Leveraging these insights will not only expand market reach but also solidify a competitive advantage in the rapidly changing landscape.

Lastly, it is crucial for entrepreneurs to remain aware of the geopolitical landscape, especially when considering international opportunities in regions such as Kenya. By combining political science acumen with their business strategies, entrepreneurs can navigate the challenges posed by third world governments and leverage emerging markets. In doing so, they can position their businesses for sustainability and success within the global foodservice ecosystem.